Author: Daniel Schwarcz Date: 10.12.21

Insurers and policyholders have different perspectives on whether ordinary business interruption policies cover losses stemming from pandemic-induced shutdowns. But both groups should be able to agree that the judicial process for resolving these disputes makes no sense. After thousands of lawsuits, hundreds of judicial opinions, and a year-and-a-half of attorneys’ fees, clarity regarding insurers’ coverage obligations remains elusive. Although insurers have prevailed in a significant majority of the motions to dismiss that they have filed in these cases, policyholders have also scored a meaningful number of victories. This is particularly true in state courts, which will ultimately have the final word on the proper interpretation of business interruption policies. It is way too early, in other words, to declare insurers the victors in these coverage contests.

This costly and indeterminate process for resolving pandemic business interruption disputes was entirely predictable. In many ways it echoes the decades-long litigation over prior widespread coverage disputes, like those involving CGL insurers’ coverage obligations for liability arising under CERCLA. But the chaotic resolution of pandemic business interruption disputes may not have been inevitable.

That, at least, is the possibility suggested by the United Kingdom’s innovative “test case” scheme for resolving its own pandemic business interruption coverage disputes. Under that scheme, the country’s primary market conduct regulator for insurers, the Financial Conduct Authority, asked the British courts to find coverage under a representative sample of insurance policies that covered business interruptions caused by the presence of disease or denial of access to property. Within about 6 months, the country’s high court definitively resolved this test case, in the process providing “authoritative guidance for the interpretation of similar policy wordings and claims.” Since early 2021, the coverage obligations of most U.K. insurers for pandemic-induced shutdowns have thus been quite clear.

To be sure, there are crucial distinctions between the British and American settings that would make a test case scheme unworkable in the U.S. Still, the contrasting experiences of the two countries suggests some ways to improve the U.S. system by adopting elements of the British approach. After all, the insurance coverage questions raised by the pandemic are hardly the first example of widespread coverage disputes in the U.S. being inefficiently resolved through hundreds of lawsuits that generate mass uncertainty and span years, if not decades. And absent broad-ranging reforms, they will certainly not be the last.

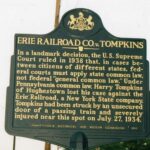

Taking that possibility seriously, my new Article suggests that states should empower their insurance regulator and attorney general to request that federal courts adjudicating cases raising novel coverage questions implicated in emerging and widespread coverage disputes certify those questions to the state’s supreme court. Unlike the UK’s test case scheme, this proposal would focus public state actors solely on identifying a set of pending coverage disputes wherein the exercise of federal courts’ long-standing certification authority would be most likely to help. Public officials would play no role in litigating the merits of these coverage disputes, leaving that task to private parties already embroiled in existing litigation. Not only could this proposal help limit the uncertainty and costs produced by litigation like the pandemic BI coverage cases, but it could also affirm the primacy of state, rather than federal, courts in deciding highly consequential and contested questions of state insurance law.