Policyholders are winning motions to dismiss in cases without virus exclusions.

We are working on a graphic to depict the following finding in dynamic fashion (so that it updates automatically as our data develop), but in the meantime here is a significant finding that hasn’t yet been reported.

Of the seven cases in which a merits-based motion to dismiss has been denied, four involve insurance policies without any virus exclusion, one involves the Hartford’s Endorsement for Limited Fungi, Bacteria, or Virus Coverage (which contains a virus exclusion that could be read to apply only to losses involving defective materials), and two have virus exclusions that apply to sickness or disease.

By contrast, of the eighteen cases in which a court has granted a merits-based motion to dismiss, only two don’t have virus exclusions.

This matters, among other reasons because the presence of a virus exclusion inhibits policyholders from pleading their cases in ways that would help them meet the requirement that their business income losses result from “physical loss of or damage to” the premises in question.

Bottom line: insurers are winning, overwhelmingly, when their policies have virus exclusions. But they are losing, at least at the motion to dismiss stage, when their policies do not have virus exclusions.

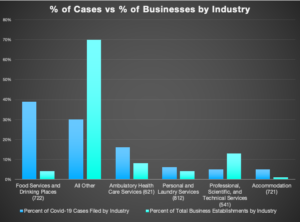

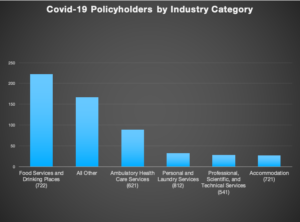

Food Services and Drinking Places are leading the pack, with 40% of the cases, followed by Ambulatory Health Care Services with 16% of of the cases. Most of the ambulatory health services plaintiffs are dentist offices (59 out of the 87 cases in that category). The share of cases represented by other industries quickly falls off after these two.

Food Services and Drinking Places are leading the pack, with 40% of the cases, followed by Ambulatory Health Care Services with 16% of of the cases. Most of the ambulatory health services plaintiffs are dentist offices (59 out of the 87 cases in that category). The share of cases represented by other industries quickly falls off after these two.