Author: Jordan Einstein Date: 06.29.20

Covid-19 has forced businesses of all industries and sizes around the country to overhaul their operations to minimize human contact and curtail transmission of the novel virus. Businesses deemed “essential” swiftly implemented new safety and operating protocols necessary to remain open, while “non-essential” businesses largely shut down immediately. Professional sports leagues are among the “non-essential” businesses. As fans anxiously await their return, along with a sense of normalcy and hope, leagues and player associations have gone back-and-forth over the logistics of starting back up.

Major League Baseball has been at the forefront of recent discussions with seemingly every detail of the league’s negotiations with the MLB Players Association being publicized and scrutinized. By contrast, there has been little discussion about Minor League Baseball (“MiLB”), which is unlikely to see a single game played in 2020.

Unlike Major League Baseball, where players can earn millions of dollars and clubs are owned by billionaires, MiLB organizations are more akin to small businesses—at least from a financial perspective. As detailed in a complaint recently filed in the Eastern District of Pennsylvania by a collection of minor league organizations, minor league teams incur considerable fixed costs in the form of lease payments to municipal ballpark owners and salaries to permanent employees responsible for handling business operations year-round. Yet their revenue varies significantly, because most minor league teams depend on ticket sales as their primary revenue (as opposed to MLB clubs who earn revenue from a variety of sources including advertising and television contracts, among others).

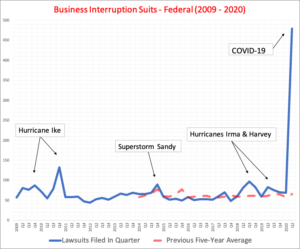

Because of the shut-down, minor league teams across the country are struggling to stay afloat financially, as attendance plummets from a record-setting 40 million fans last year to zero this season. Similar to many other small businesses, minor league organizations are seeking coverage from insurance companies under the business income, extra expense, and civil authority provisions of their businessowner policies.

Despite the unique nature of their industry, the organizations’ insurance policies are unremarkable. In total, the fifteen organizations are insured under nine separate businessowner package policies issued by five different insurance companies—Philadelphia Indemnity Insurance Company, Acadia Insurance Company, National Casualty Company, Scottsdale Indemnity Company, and Scottsdale Insurance Company. All but two of the nine policies—both issued by Philadelphia Indemnity—contain the same Building And Personal Property Coverage (CP 00 10 10 12), and Causes Of Loss – Special (CP 10 30 09 17), forms. Five of those seven policies also contain the same Business Income And Extra Expense Coverage form (CP 00 30 10 12), while the other two use an older edition of the same form (CP 00 30 06 07). Moreover, eight of the nine policies include the same virus exclusion form (CP 01 40 07 06), the lone exception being the sole policy issued by Acadia.

Perhaps more surprising than the similarities between organizations’ policies is the similarity between their policies and those from businesses in other industries. For instance, all the forms listed above are standard ISO coverage forms and endorsements, which are routinely included in businessowner and commercial property policies issued by a variety of insurance companies. Interpreting the language and causal requirements in those standard ISO forms will be a focal point of Covid-19 insurance coverage litigation for all policyholders, not just minor league teams.

Nonetheless, the nine policies are not identical, so there may be some variation in what is ultimately covered and excluded. For example, the Philadelphia Indemnity policies contain an advisory notice (CP P 003 07 06) regarding the applicability of the included virus exclusion form; the other six policies with the same virus exclusion form (CP 01 40 07 06) do not include advisory notices. Moreover, Acadia used a different virus exclusion form authored by the AAIS (CL 0700 02 07). The Philadelphia policies also contain a Sports And Entertainment Event Protection endorsement (PI-AM-072 (06/09)), which is not included elsewhere. It is unclear how courts will interpret those variances, but given the technical nature of insurance litigation, they are notable.

In summary, Chattanooga Professional Baseball LLC et al v. Philadelphia Indemnity Insurance Co. et al is a relatively unremarkable case from an insurance coverage perspective, despite its connection to professional baseball. Because minor league organizations are more comparable to small businesses than billionaire-owned Major League clubs, the outcome will be incredibly significant to the financial viability of the clubs and their owners, no matter how boring insurance coverage litigation may be for typical baseball fans to follow. Instead of the more exciting legal discussions about player contracts and a potential grievance against the league, this case compares more closely to other Covid-19 business interruption insurance cases, which will turn on legal details like the difference between “direct physical loss or damage” and “direct physical loss or direct physical damage,” what qualifies as “physical damage,” and whether the “efficient proximate cause” of business closures was the novel coronavirus itself or the civil authority orders forcing businesses to shut down.